In general terms, the bond market will rally when increases in the Consumer Price Index (CPI) (inflation) are small and the bond market will fall when increases in the CPI are large. The equity markets generally follow the same trend as the bond market when responding to CPI numbers. In other words, the equity market will (generally) rise when CPI numbers are small because low inflation leads to low interest rates, which are good for corporate profits.

But are there certain S&P 500 sectors that might perform better if inflation rises?

Inflation Rose in November and December

On January 12th, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index increased 6.5% over the past 12 months. Shockingly, media outlets ran with absurd headlines like these: “Annual Inflation Slowed to 6.5%” and “December CPI Report Shows Cooling Inflation” and even this one: “December’s ‘very favorable’ inflation read could signal the ‘final phase of the bear market’ and stave off a recession.”

Ok, maybe it’s technically true that inflation declined 0.1% in December, but an annual inflation of more than 6% is still very high. Maybe this will hit home more: that 10% return on your portfolio is not 10% after 6.5% inflation. Not even close.

Most importantly, you should remember this: Inflation can do a number on retirees’ incomes. Most people don’t think about that, but with longer lifespans, we run a real risk of seeing our retirement savings eaten away. Curbing its impact takes planning.

Where to Invest During Rising Inflation

Generally speaking, financial professionals would most likely suggest that cash is one of the worst asset classes to hold during rising inflationary periods. And in theory, there are some sectors that generally perform better than others if inflation rises.

For example, when there is high inflation, companies will pass the rising costs onto consumers, right? And it stands to reason that if you and I become more selective when we purchase goods and services, we might forgo some luxury items (think jewelry), but we will keep buying basic necessities (like bread and milk). And that explains why the Consumer Staples sector generally perform better during rising inflationary periods and the Consumer Discretionary sector generally performs worse.

Gold (and Gold Stocks)

Generally speaking, institutional investors often turn to perceived “safe” investments like gold and gold stocks when inflation is on the rise. Why? Well because gold is considered to be safe haven during periods of economic instability.

Energy (Oil and Oil Stocks)

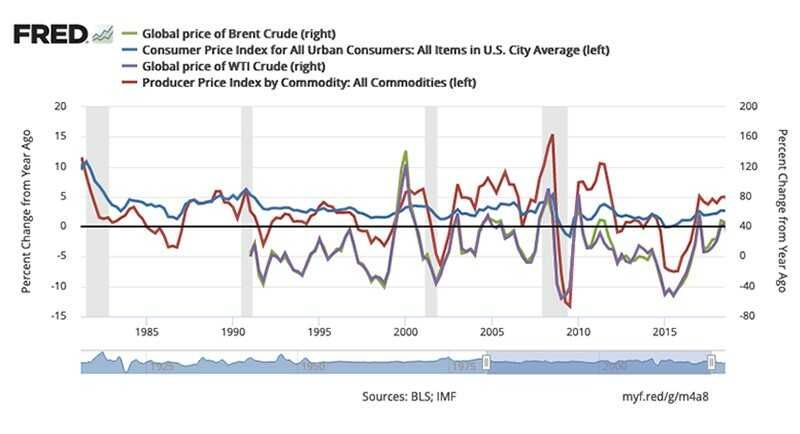

Interestingly, there is a positive correlation between the price of oil and inflation. In fact, according to the St. Louis Federal Reserve:

“The graph shows a strong positive relationship between oil prices and Producer Price Index (PPI) inflation: That is, higher oil prices are associated with higher producer prices and vice versa. Specifically, the correlation between oil prices and the PPI is 0.71. This strong link likely comes from the importance of oil as an input in the production of goods.

Utilities Sector

Utilities are generally considered defensive as we all still need them (think electricity, heat, gas, etc.) no matter the inflationary environment. And since energy companies pass any higher costs onto us, they are able to maintain their profitability.

Real Estate Sector

The Real Estate sector is often a hedge against inflation too. Consider the largest component of the sector – Real Estate Investment Trusts. REITs own and operate income-producing real estate and property prices and rental income tend to rise when inflation rises. Further, REITs are required by law to pay out at least 90% of their net earnings to shareholders annually.

Allocations Matter

Want more proof on the importance of asset allocation and diversification in one’s portfolio returns? Consider the performance of the sectors just mentioned last year (save Gold):

S&P 500 Sector | 2022 |

Information Technology | -28.8% |

Energy | +57.8% |

Health Care | -3.2% |

Real Estate | -27.7% |

Consumer Staples | -2.7% |

Consumer Discretionary | -37.4% |

Industrials | -6.7% |

Financials | -12.1% |

Materials | -13.4% |

Communication Services | -40.4% |

Utilities | -0.5% |

Source: FMR

Notice a pattern? Again, those variations are the epitome of sector rotation and the numbers empirically identify the importance of asset allocation and diversification for all investors.

But last year’s sector performance might suggest that if inflation does indeed remain high in 2023, last year’s beaten-down sectors might be worth another look.

Have specific questions? Don't hesitate to reach out to me today

Wes Garner, CRPC

Principal Wealth Strategist

(281) 269-8669

wgarner@tdecu.org

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. All indexes are unmanaged and cannot be invested into directly.

Past performance is no guarantee of future results.

Because of their narrow focus, investments concentrated in certain sectors or industries will be subject to greater volatility and specific risks compared with investing more broadly across many sectors, industries, and companies.

Investing in Real Estate Investment Trusts (REITs) involves special risks such as potential illiquidity and may not be suitable for all investors. There is no assurance that the investment objectives of this program will be attained.

Asset allocation does not ensure a profit or protect against a loss.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

S&P 500 Index: The Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization US stocks.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Producer Price Index (PPI) is an inflationary indicator published by the U.S. Bureau of Labor Statistics to evaluate wholesale price levels in the economy.

All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by FmeX.

LPL Tracking #1-05356376