With digital banking becoming so popular, knowing your financial institution's routing number is almost as important as knowing your phone number. In combination with your account number, this information is used to cash or deposit checks, for wire transfers, ACH fund transfers, direct deposit of paychecks, Social Security payments, and other automatic payments or withdrawals.

If you use digital banking, or if you’ve ever filled out a direct deposit form or other paperwork that requires your account information, chances are you’ve had to input your financial institution’s unique “routing number.” And when you download a mobile app you’ll want to make sure you know how to find your financial institution's account number and the routing number. Originally developed in 1910 by the American Bankers Association, ABA routing numbers were designed to facilitate sorting, bundling, and shipment of checks back to the check writer’s account. A routing number, or ABA routing transit number (ABA RTN), is a nine-digit code used by financial institutions in the United States.

Find Your Routing Number

Look at the set of numbers on your personal checks, see the example below, to find the routing number, your full account number, and the check number. If you have a savings account at the same financial institution, the accounts will not have different routing numbers. Routing numbers are unique to each financial institution, not the account.

Generally speaking, then, the code usually appears at the bottom of checks to indicate the financial institution from where the funds are drawn. You can also usually find a bank or credit union’s routing number in the footer of their website. You can also usually look up your routing number on your savings deposit slip.

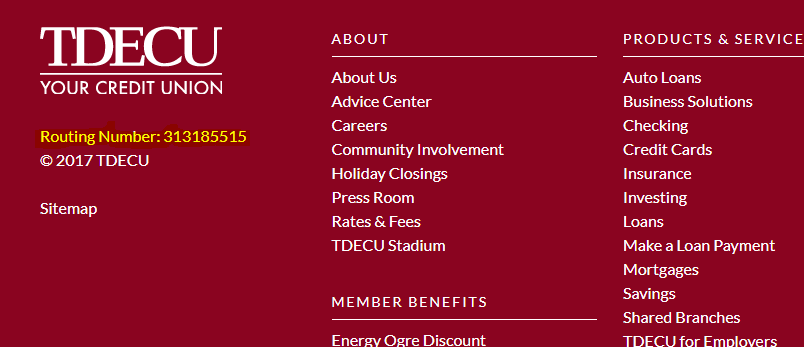

You can find TDECU's routing number on our website in the footer of each page (see highlighted text in the footer image below), on your checks as the first set of nine numbers (see the check example below) and on the “Contact Us” page. Our routing number is 313185515.