Introduction: Picking Up Speed

In the first half of 2021, the U.S. economy powered forward faster than nearly anyone had expected. As we were writing our Outlook for 2021 in late 2020, our economic views were significantly more optimistic than consensus forecasts—but in retrospect, not nearly optimistic enough. Our theme was getting back on the road again and powering forward. But as the economy accelerates to what may be its best year of growth in decades, power has been converted to speed and we’re trading highways for raceways.

Speed can be exhilarating, but it can also be dangerous. The overall economic picture remains sound, likely supporting strong profit growth and potential stock market gains. But the pace of reopening also creates new hazards: Supply chains are stressed, some labor shortages have emerged, inflation is heating up—at least temporarily—and asset prices look expensive compared to history.

Markets are always forward looking, and in LPL Research’s Midyear Outlook 2021: Picking Up Speed, we help you keep your eyes on the road ahead. The next stretch may be a fast one and will have its share of opportunities, but also new risks to navigate. As always, sound financial advice can be as important as ever to help steer you through the environment and put in the miles toward meeting your long-term financial goals.

Economy: Speeding Ahead

The U.S. economy has surprised nearly everyone to the upside, as it speeds along thanks to vaccinations, reopening, and record stimulus. The growth rate of the U.S. economy may have peaked in the second quarter of 2021, but there is still plenty of momentum left to extend above-average growth into 2022. Despite the natural challenges of ramping back up, the recovery still seems capable of providing upside surprises.

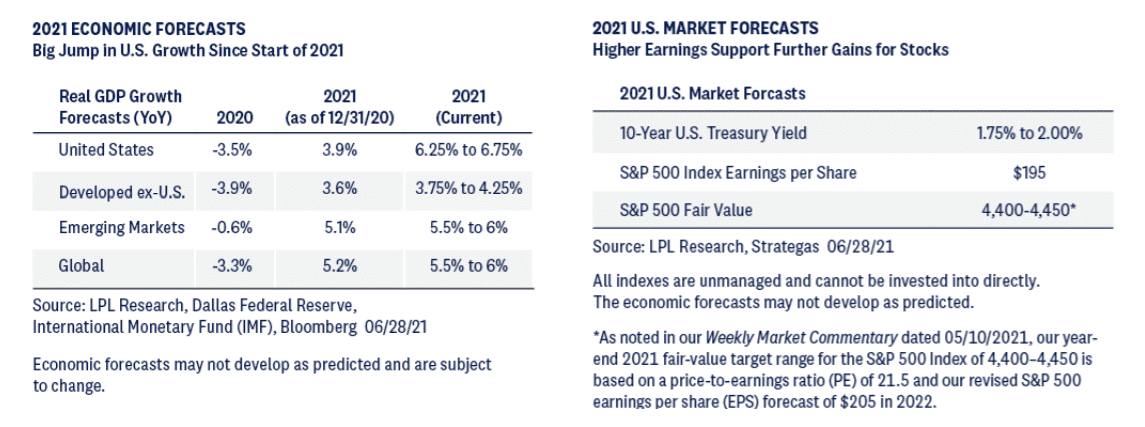

We forecast 6.25–6.75% U.S. GDP growth in 2021, which would be the best year in decades. Last year’s 3.5% drop in GDP, the worst year since the Great Depression, may not be forgotten—but it has been left in the dust of 2020.

We continue to watch inflation closely but believe recent price pressures are transitory and will begin to work their way off gradually later in the year. The average U.S. expansion since World War II has lasted five years and much longer over the last few decades. There’s nothing on the horizon to indicate the current expansion can’t reach that mark.

Economy: Speeding Ahead

The U.S. economy has surprised nearly everyone to the upside, as it speeds along thanks to vaccinations, reopening, and record stimulus. The growth rate of the U.S. economy may have peaked in the second quarter of 2021, but there is still plenty of momentum left to extend above-average growth into 2022. Despite the natural challenges of ramping back up, the recovery still seems capable of providing upside surprises.

We forecast 6.25–6.75% U.S. GDP growth in 2021, which would be the best year in decades. Last year’s 3.5% drop in GDP, the worst year since the Great Depression, may not be forgotten—but it has been left in the dust of 2020.

We continue to watch inflation closely but believe recent price pressures are transitory and will begin to work their way off gradually later in the year. The average U.S. expansion since World War II has lasted five years and much longer over the last few decades. There’s nothing on the horizon to indicate the current expansion can’t reach that mark.

Policy: Taking a Back Seat

The economy was supported through the pandemic by more than $5 trillion in stimulus measures and extraordinary support by the Federal Reserve (Fed). Policy was also in the foreground as safety restrictions created a heavy economic burden for many businesses and families. But policy will take a back seat in 2021 as reopening and private sector growth replaces stimulus checks.

The biggest policy risk may be around taxes, with businesses and wealthy households both facing the prospect of a higher tax burden to pay for the plan and help manage the deficit. Historically higher personal tax rates have had only a modest impact on markets, but higher corporate taxes would have a direct impact on earnings growth, potentially limiting stock gains.

Stocks: Gaining Ground

The second year of a bull market is often more challenging than the first, but historically still usually sees stocks climb higher. We expect the strong economic recovery to continue to drive strong earnings growth and support further gains for stocks. However, after one of the strongest

starts to a bull market in history—including a nearly 90% gain off the March 23, 2020 lows through June 28, 2021—stock prices reflect a lot of good news. As inflationary pressures build and interest rates potentially rise further, the pace of stock market gains may slow.

Economic improvement should continue to support S&P 500 earnings, which had a stunning first quarter. While valuations remain somewhat elevated, we think they look reasonable after considering still low interest rates and earnings growth potential. Our 2021 year-end S&P 500 fair-value target range of 4,400–4,450 is based on a PE of 21.5 and our 2022 S&P 500 EPS forecast of $205.

Bonds: Safety Features

Interest rates have moved off their historically low levels in the first half of the year, but we believe they can still go higher. Higher inflation expectations, the strong economic recovery, and a record amount of Treasury issuance this year are all reasons why we believe interest rates can move higher. Our target for the 10-year Treasury yield at the end of 2021 is between 1.75% and 2.0%.

Such a move would leave core investment grade bonds near flat over the rest of the year. Nevertheless, bonds still can play an important role in a portfolio as a source of income and as a diversifier during equity market declines.

We are also closely watching the Fed, which may announce plans to reduce its bond purchases later in the year. Any withdrawal of Fed support will likely be small, but could send signals on the future path of rates.

Midyear Outlook 2021: Picking Up Speed was designed to help you navigate a year in which economic conditions may continue to improve dramatically. Understanding the road immediately ahead is essential for navigating its twists and turns, but it will be thoughtful planning and sound financial advice that will keep us on the journey.

For more investment insights, read the full Midyear Outlook 2021: Picking Up Speed.

IMPORTANT DISCLOSURES

Please read the full Midyear Outlook 2021: Picking Up Speed publication for additional description and disclosure.

The opinions, statements and forecasts presented herein are general information only and are not intended to provide specific investment advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Any forward-looking statements including the economic forecasts may not develop as predicted and are subject to change based on future market and other conditions. All performance referenced is historical and is no guarantee of future results.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

Diversification does not protect against market risk. Investing in foreign and emerging markets debt or securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability.

Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to earnings valuation ratio.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Investing in stock includes numerous specific risks including the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market. Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Bond yields are subject to change. Certain call or special redemption features may exist which could impact yield. Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk, as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features. Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

Fixed Income definitions

Credit quality is one of the principal criteria for judging the investment quality of a bond or bond mutual fund. As the term implies, credit quality informs investors of a bond or bond portfolio’s credit worthiness, or risk of default. Credit ratings are published rankings based on detailed financial analyses by a credit bureau specifically as it relates the bond issue’s ability to meet debt obligations. The highest rating is AAA, and the lowest is D. Securities with credit ratings of BBB and above are considered investment grade.

Tracking #1-05155985 (Exp. 07/22)