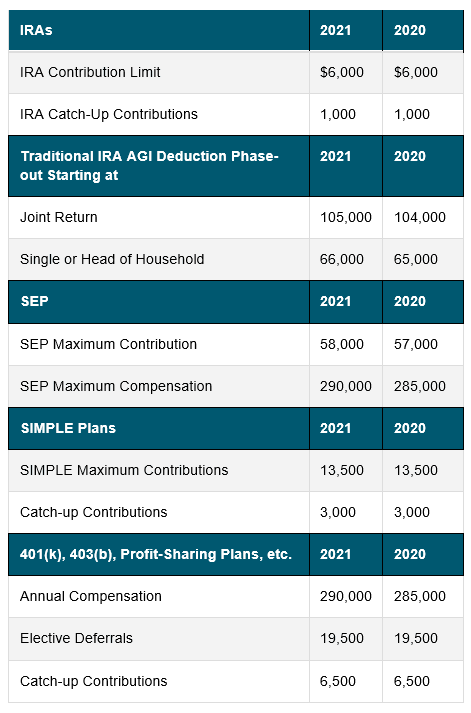

Tax law places limits on the dollar amount of contributions that you can make to Individual Retirement Accounts and by law, the IRS is required to adjust these limits annually for cost-of-living increases.

Going into 2021, you should familiarize yourself with these adjustments, so that you’re better informed as we plan for your retirement.

Highlights of the 2021 Changes

As you probably know, you can deduct contributions to a traditional IRA if you meet certain conditions, but the amount of the deduction will depend on your income (or joint income). Specifically, if you or your spouse are covered by a retirement plan at work, then the deduction may be reduced or phased out altogether.

As such, it is important to be aware of the income ranges that the IRS uses for determining eligibility to make deductible contributions as these income ranges and the dollar amount of allowed contributions can change from year to year with cost-of-living-adjustments. Further, it’s important to know the differences between a traditional and a Roth IRA too.

Phase-out Ranges

Here are the traditional IRA phase-out ranges for 2021, lifted directly from the IRS:

- $66,000 to $76,000 – Single taxpayers covered by a workplace retirement plan.

- $105,000 to $125,000 – Married couples filing jointly. This applies when the spouse making the IRA contribution is covered by a workplace retirement plan.

- $198,000 to $208,000 – A taxpayer not covered by a workplace retirement plan married to someone who's covered.

- $0 to $10,000 – Married filing a separate return. This applies to taxpayers covered by a workplace retirement plan.

Here are the income phase-out ranges for taxpayers making contributions to a Roth IRA:

- $125,000 to $140,000 – Single taxpayers and heads of household.

- $198,000 to $208,000 – Married, filing jointly.

- $0 to $10,000 – Married, filing separately.

What Should You Do?

Taxes are complicated enough and reading, learning and implementing tax strategies that are most appropriate for you can be a daunting task.

As we head into the new year, as your financial professional I will help ensure that the tax decisions you make are consistent with your overall financial plan.

Have specific questions? Don't hesitate to reach out to me today

Wes Garner, CRPC

Principal Wealth Strategist

(281) 269-8669

wgarner@tdecu.org

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly.

The information provided is not intended to be a substitute for specific individualized tax planning or legal advice. We suggest that you consult with a qualified tax or legal advisor.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

This article was prepared by FMeX.

LPL Tracking # 1-05079937