On the flip side, you can bypass all of the responsibilities of homeownership and continue renting, but rather than building equity and investing in your own future, your rent builds equity and value for your landlord.

If you think you are ready to take the next step and become a homeowner, you need to answer the question, “Should I buy a starter home or wait until I can afford my dream home?” There are two sides to every situation and much to think about. Here are some important considerations for you to think about as you enter into the world of homeownership.

Consider First Things First

Before you can seriously begin to think about moving forward with a home purchase your finances need to be in order. This means you have saved enough money for a down payment on a mortgage (usually 5 to 20 percent of the purchase price for a conventional loan) as well as closing costs (anywhere from 2 to 5 percent of the purchase price).

Another consideration is your FICO score. You may be wondering why your FICO score is another important factor when you are preparing to buy a home. Having the funds and getting the loan are only part of the equation when it comes to becoming a homeowner. Your FICO score is a huge factor when it comes time for lenders to give you their best interest rate and loan terms. While it does not guarantee you will be offered the lowest interest rate, a higher FICO score is a good predictor that you will have better loan options than someone with a lower score.

Timing and the Price of Your Home

Across the country, the real estate market is strengthening. It has been a long time since buyers have had to compete to buy a home; until now. While a stronger real estate market is positive, it also means home prices and competition for homes are on the rise. In many cases there are multiple offers on the same home – often as soon as the home hits the market.

It is likely time to consider whether to move forward and buy before prices get higher. On one hand you can jump into the race now and buy a starter home you can afford. More importantly, you can begin to build equity you can use to buy your dream home down the road. On the other hand, you can continue to wait and save, holding out for your dream home. If you choose to wait, think about how you will feel if your dream home never gets within reach due to increasing home prices.

Ultimately, money is most often the deciding factor between buying a starter home or your dream home.

Starter Home or Dream Home

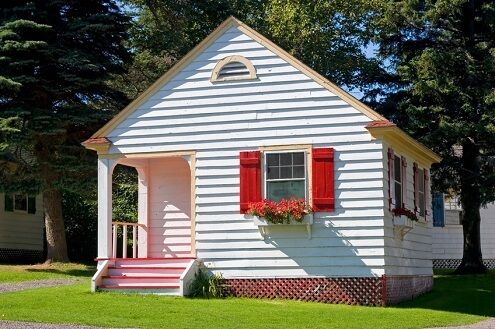

You probably have an idea in mind of what constitutes a starter home. Generally speaking a starter home is a dwelling you buy with plans to live in for about five years. It does not possess all the bells and whistles like your dream home, but it is “good enough for now”. Ideally, your starter home will allow you to build equity until you are ready to sell it and “move up”.

A dream home, on the other hand, is one you envision yourself living in for the rest of your life, or at least the next 20 or 30 years. It has most, if not all, of the items on your wish list and will at least accommodate the next several phases of your life. Unless you plan to downsize to a smaller home during retirement, you see yourself paying off the mortgage and living in your dream home for the long haul.

Buying a Starter Home

There are benefits to buying a starter home. With interest rates at historic lows, the timing is good to lock in a lower rate mortgage. The downside to postponing buying a home now is that mortgage rates fluctuate and there is no guarantee what rates will be in the future. Your mortgage rate will impact your monthly house payment and the amount of interest you pay over the life of your loan. The lower your rate, the lower your payment is each month.

Inventory is another consideration. Houses go up for sale everyday, but currently inventory is low. Lower inventory can lead to greater competition for the best properties – often creating bidding wars that drive up the price of the home. While this is good for the seller, the purchase price may end up exceeding market value, which may require you to bring a larger down payment to the table. It may also require you to wait longer to move into your dream home if it does not appreciate in value and create useful equity.

An alternative to selling your starter home is to use it as income-producing rental property. A key factor when renting your starter home is pricing it right. Ideally, you want the rental income to at least pay the home’s mortgage and insurance costs, if not exceed it. While renting the home, you buy time for the property to appreciate in value so you can sell it in the future. But, keep in mind that a smaller home may be more difficult to rent. Do your research and ask your Realtor® for their professional advice.

Additional thought should be given to the potential need for home improvements. If you set your sights on a starter home and have a long list of repairs or desired enhancements, you will want to prioritize and limit what you do to avoid losing money when you sell. A good rule of thumb is to research the characteristics of other homes in the same area. This will keep your improvements in check and similar to others in the market.

Buying a Dream Home

When you think of a dream home, you probably see it as the house you will be in “forever”. Even if you have saved enough money to afford your dream home, are you sure of everything you want and need to make your home functional throughout your lifetime? Are you ready to settle down for 20 to 30+ years or do you like the idea of moving as your needs change?

Not being able to afford a “forever home” in your 20’s or 30’s is more common than not. Economic factors such as increasing real estate prices, greater personal debt and flat incomes are very real barriers to owning your perfect place. It most likely requires a two-income household, which still may not be enough in some of the more expensive markets across the country. The idea of your “perfect place for right now” may be the most realistic and will provide an opportunity to see what you like and don’t like about owning a home.

If you choose to continue renting for a few years while you save up for your dream home, you run the risk of rising interest rates and rising home prices as was mentioned in the previous section. Of course, the upside to renting and saving longer is a larger down payment and that means having a smaller mortgage loan and monthly payment.

By holding out for your dream home, you potentially avoid being stuck in a starter home longer than you anticipate. Then again, if market conditions are less than ideal when you are ready to sell and purchase a home closer to your idea of a dream home, you have the option of becoming a landlord. Rent as a source of income has many benefits, including the opportunity to add to your savings (as long as you can clear your mortgage, homeowner’s insurance and taxes).

The market is not always predictable and home prices and interest rates can drastically change. One risk of waiting for your dream home is that it may be less affordable in the future than it is today. Your income may increase while you wait to make your move, but can you really be sure it will? That is a chance you take by waiting and not investing in a home that is “good enough” for now.

Do the Math

What do you estimate is the difference in cost between your starter home and your dream home? If you can save the difference in a year then you may want to wait − as long as you are sure you know the features you want and the functionality you need. On the other hand, if the difference between the two will take more than five years to save, you may want to unlock the door to your starter home and begin building equity. Less home and lower payments now can lead to more down the road when you are ready. Find a place that meets your current needs and enjoy the things it has to offer for a few years until you can afford to move up to something closer to your dream home.

Resources:

http://www.zillow.com/mortgage-learning/closing-costs/

http://landlords.about.com/od/Landlord101/a/5-Tips-For-Setting-The-Right-Rent.htm

https://smartasset.com/mortgage/what-credit-score-is-needed-to-buy-a-house