Savings and Checking Accounts

Smart. Convenient. Secure.

Money management solutions from TDECU

Savings and Checking Solutions

Between our checking, savings, and investment products, we have you covered.

Savings Accounts

We offer a full range of savings account options to help you meet your savings goals. If you are new to TDECU, remember the Share Savings account is required to initiate your membership benefits.

Checking Accounts

Our checking accounts feature no monthly minimums, access to surcharge-free ATMs and the option to earn up to 20x the national average on your account balances.1

Certificates of Deposit (CD)

A CD is a secure way to invest your money with guaranteed returns. Choose a term between 3 and 60 months, and watch your savings grow.

Money Market Account (MMA)

An MMA is the right choice if you want to earn a higher rate on your account balance, but still have the flexibility to withdraw funds.

Individual Retirement Account (IRA)

An IRA is an investment tool that helps you save for retirement, either with tax-free growth or on a tax-deferred basis.

Get started today and enjoy the benefits of banking with TDECU

Bank Conveniently

Manage your accounts on the go with the TDECU Digital Banking app

Earn More

With a Value Plus Checking account from TDECU, you can earn 20x the national average

Rest Easy

All TDECU deposit accounts are insured up to $250,000 by the National Credit Union Administration. Learn more about the NCUA on our blog.

New to TDECU?

Start off right when you apply online as a new Member. We will deposit $5.00 directly into your Share Savings Account to help you start your savings journey.

The right solutions to help you navigate your financial journey

TDECU understands your banking needs and helping you achieve your financial goals remains one of our top priorities. We designed our products to support you no matter where you are in your financial journey — from opening your first checking account to planning for retirement. Plus, as a TDECU Member, you get to enjoy better savings rates, access to over 55,000 ATMs worldwide, and our digital banking app, allowing you to manage your accounts from anywhere, at anytime.

Remote Services

Everyday services should be fast and convenient. TDECU upholds this promise with multiple ways to manage your accounts, wherever and whenever.

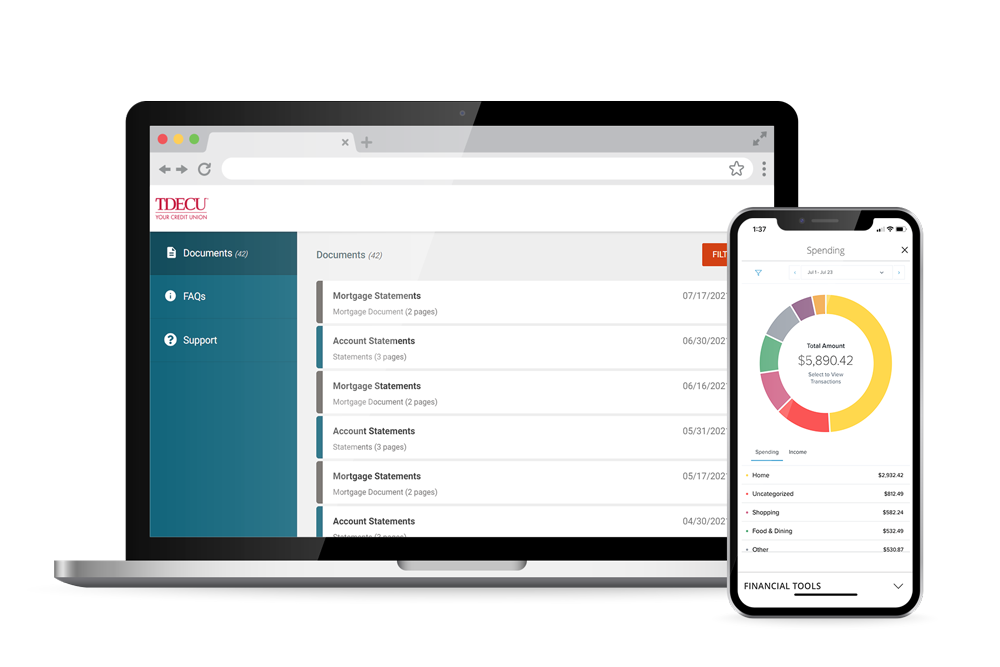

Digital Banking

Manage your accounts on the go with the TDECU Digital Banking app.eDocuments

Access your statements anywhere you have an online connection.Telephone Banking System

Request account information via our telephone banking system, available 24/7.Order Checks

Re-order checks through our online fee-free service.Visa® Debit Card

Use your debit card to access your accounts from thousands of surcharge-free ATMS around the world.1Must be at least 18 years of age to open a Value Plus Checking (VPC) account with a limit of one account per Member. The minimum opening deposit is $50.00. Highest APY includes 3.00% on VPC balances <$50,000.00 and 0.25% on VPC balances >$50,000.00. Account holders will receive a maximum monthly rebate of $30.00 on non-TDECU ATM fees. Rates are subject to change without notice. APY is as of 8/1/25. Other terms/conditions apply. Contact TDECU for complete details. Insured by NCUA.