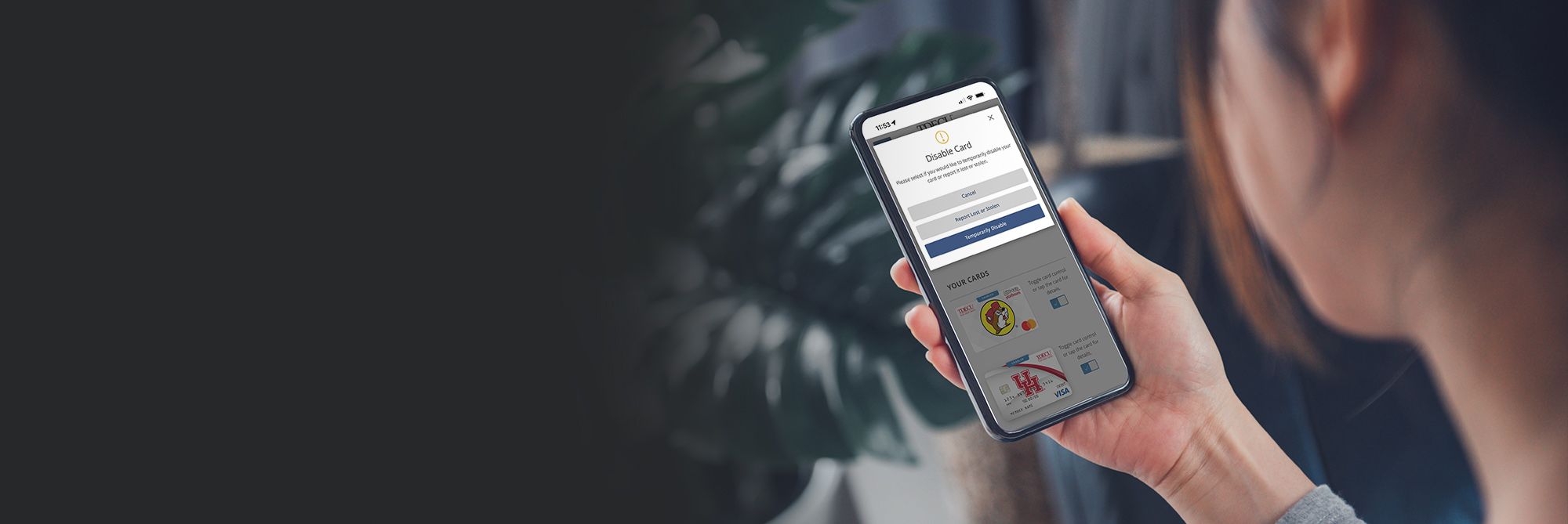

Power in the palm of your hand

with card controls from TDECU

Questions?

Take control of your debit and credit cards

Right from your smart phone or desktop, our card control features make it fast and easy to perform a variety of tasks, giving you the power to manage your cards when it matters the most.

With TDECU card controls, you can:

- Temporarily lock your card if you misplace it

- Deactivate a lost or stolen card

- Set up travel notifications so your card is ready to travel with you

Enjoy these card control features today. It’s free, fast and easy. Find them under the Service Center when you log in to TDECU Digital Banking.

Frequently Asked Questions

- Ability to activate your Debit Card.

- Ability to disable/re-enable your Debit Card or Credit Card.

- Ability to report your Debit Card or Credit Card lost or stolen.

- Ability to set controls and alerts for selected merchants or transaction types.

- Ability to set travel notifications.

- Log into TDECU Digital Banking

- Click on Service Center from the Navigation Menu

- Click on Manage Cards

- Tap on card and enter: Exp Month, Exp Year & CVV that is located on the back of the physical card

- Click Activate

-

- Activation may only happen once you receive your new card.

- Management of your card may only happen once you have received and activated your new card.

- Start by selecting the Service Center button followed by the Manage Cards option. You can then swipe the toggle to temporarily disable your card from either the Card Services screen or Card Details screen.

- Disabling your card will prevent any further transactions but will not permanently deactivate your card.

- You may disable or re-enable your card at your leisure which will take effect immediately. However, pre-authorized and/or reoccurring charges, such as Netflix, Spotify, or a phone bill may still be debited while your card is disabled.

- Log into TDECU Digital Banking

- Click on Service Center from the Navigation Menu

- Click on Manage Cards

- Tap on card or click on Card Details

- Click on Report Lost or Stolen

-

- When reporting a card lost or stolen you will need to complete a short questionnaire. This information will be used to alert TDECU of any potential fraud on the account.

- Once submitted, your card will be permanently deactivated. TDECU will mail a new credit card to your current address on file. To receive a new debit card, send a secured message via Digital Banking, call Member Care, or visit your nearest branch.

- Once you report your card lost or stolen, the card will appear in a Lost or Stolen status within Digital Banking. When you log back in the card will no longer appear in the Card Management module.

- Spending Alerts

- Location/Travel Alerts

- Transaction Alerts

- Merchant Alerts

- Log into TDECU Digital Banking

- Click on Service Center from the Navigation Menu

- Click on Manage Cards

- Click on Travel Notifications

-

- When setting up a new travel alert you will complete the following:

- Select the Card

- Enter Departure Date and Return Date

- Select Domestic; can enter up to 10 states or select international travel and enter up to 10 countries

- Enter a traveling contact number

- From the Travel Notifications screen, you can select one or more cards to include in the travel notification. Add multiple travel destinations — both domestic and international. Remove upcoming travel dates if trips are cancelled or postponed.

- When setting up a new travel alert you will complete the following:

What type of cards are supported by the Card Management module?

What is the purpose of the Card Management module?

What features are included in the Card Management module?

How do I activate my new Debit Card?

How do I temporarily disable and re-enable my Debit Card or Credit Card?

Simply swipe the same toggle to re-enable the card.

How do I report my card lost or stolen?

Can I still make payments toward my Credit Card if it's in a disabled status?

What type of alerts are offered through the Card Management module?

Can I set controls and alerts on all my cards?

Will I receive confirmation that the controls and alerts are set up?

Yes, you will receive a secure message via TDECU Digital Banking and an email confirmation.