October 10, 2023

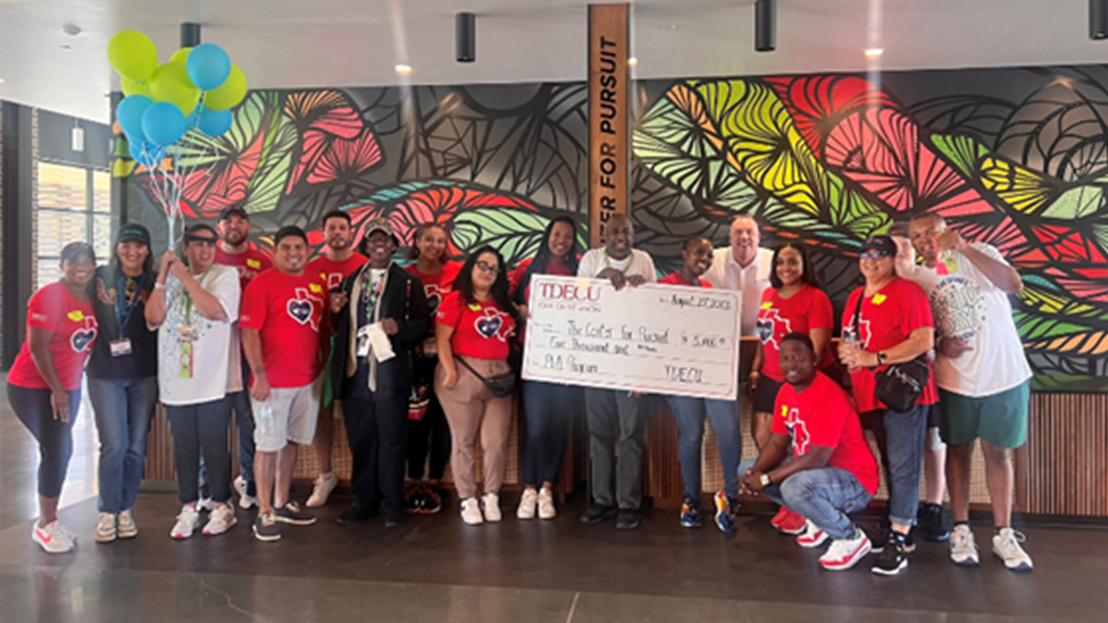

In a heartwarming alliance, TDECU recently partnered with The Center for Pursuit, a nonprofit organization dedicated to empowering individuals with intellectual and developmental disabilities, auti...

Articles

October 6, 2023

The atmosphere was electric as TDECU employees beamed smiles at the YMCA Y Teen L.I.F.E “Teenchella” event. TDECU, the event’s proud sponsor, played a significant role in making this day unforgetta...

October 5, 2023

In the fast-paced world of finance, having a reliable partner by your side can make all the difference. Meet Tex, your ultimate financial assistant, dedicated to ensuring your banking experience is...

October 4, 2023

At TDECU, we want our Members to feel assured we are keeping their accounts and information safe.

September 21, 2023

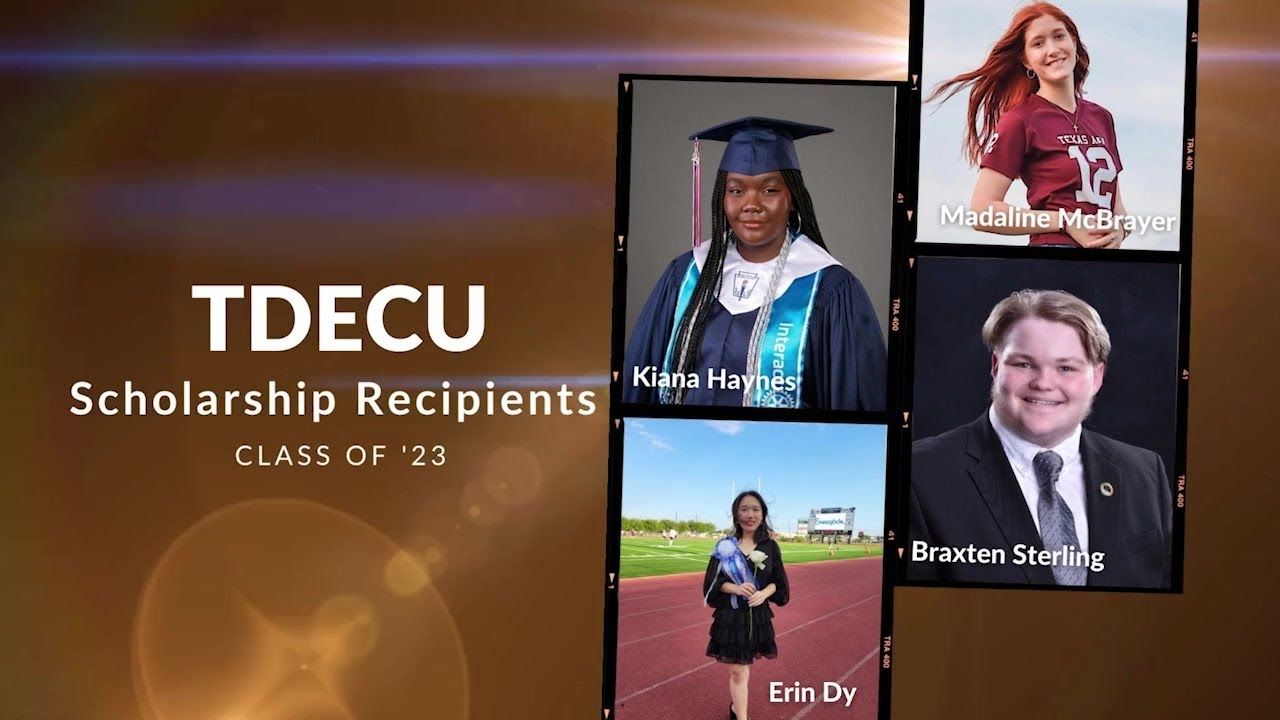

In higher education, scholarships are more than just financial support; they can represent the realization of dreams. The TDECU Student Member Scholarships are a testament to the power of education...

September 4, 2023

Managing your finances can sometimes become a challenge in today's fast-paced world. One term you might encounter while dealing with your bank accounts is “overdrawn.” But what does it mean when yo...

August 29, 2023

Credit unions play a vital role in community development, serving as financial institutions that prioritize the well-being and growth of the communities they serve. Beyond traditional banking servi...

August 15, 2023

We understand that going through a divorce can be emotionally challenging, and managing finances during this period adds additional complexity. We are here to provide you with valuable insights and...

August 10, 2023

Managing finances effectively is essential for a strong marriage in today's fast-paced world. While not a figure that is great to hear right after getting married, every four in ten marriages that ...

August 9, 2023

In today's digital age, mobile devices have become integral to our lives, enabling us to stay connected, productive, and entertained. However, with the convenience of mobile technology comes the ne...

August 8, 2023

Entrepreneurs and small business owners often face unique financial challenges while building their businesses. As they navigate the complexities of managing finances, being a credit union member c...

August 3, 2023

As the back-to-school season approaches, parents must find ways to save on school supplies, clothing, and other necessities. At TDECU, we understand the importance of stretching your budget while p...

July 7, 2023

Mobile payment transactions have become commonplace, with more businesses than ever offering contactless payment with a mobile phone. Market researchers expect to see this increase even more in the...

June 20, 2023

We don’t like to think about it, much less talk about it, but the unexpected happens every day, at every age, and for every lifestyle. Life feels complicated these days and even more unpredictable....

June 6, 2023

Are you preparing for hurricane season but don't have the right insurance? TDECU Insurance is here to help you navigate your insurance policy options.

June 1, 2023

Want to add a pool to your home for this summer? With the starting cost of a pool equal to a new car -- about $32,000 -- there is a good chance you do not have the funds sitting in your checking ac...

May 26, 2023

Although millions of people plan on using Social Security to make up part of their retirement income, how the program works is still a mystery to many, here's an overview of the basics.

May 18, 2023

If you’re age 60 or older and are still working, you may be asking yourself whether or not it still makes sense to contribute to an IRA. Find out here.

May 16, 2023

Are you worried that past financial mistakes are impacting your ability to manage your personal finances effectively? Learn how ChexSystems, Inc. gathers and reports your banking history and provid...

May 11, 2023

The cost of attending college has risen so quickly that most parents and students already know that they have to start saving money years in advance.

May 10, 2023

TDECU has been sharing tips on how to stay safe online for the past 7 years. Here is an updated blog post with all the tips and tricks we have provided on staying safe online and creating strong pa...

May 9, 2023

Have you considered how and when to use your savings account versus your checking account? To improve your financial situation, it is important to understand the key differences and distinct purpos...

May 4, 2023

The growing popularity of smart homes makes it more likely that you may purchase one in the near future. If you don't buy an existing smart home, you may decide to have one built to your specificat...

April 27, 2023

Identity theft scams are surprisingly common and subtle. Almost anyone can fall prey to them. One common form of identity theft scam involves FEMA impersonators. Learn the warning signs of FEMA fra...

April 25, 2023

Do I have enough money in my checking account? You can find the answer with the correct analysis of your finances. Keep reading for guidelines and recommendations for assessing your finances to hel...

April 24, 2023

At TDECU, we're constantly improving to increase safety and make our Members' experience easier. Our latest improvement is with our Balance Transfer feature. This blog will walk you through how to ...

April 20, 2023

A home warranty offers several advantages; however, there are some downsides to purchasing a warranty. Follow these tips to make the right choice for you.

April 18, 2023

How is it even possible not to have a credit score? Credit reports do not automatically appear when you get your social security number or open a bank account. Find out what it means if you have no...

April 11, 2023

No matter how cautious and meticulous you are when caring for your health, family members, home, or car, it is possible to be blindsided by a costly bill. Without proper planning, your financial we...

April 4, 2023

To assess how effectively you manage your income, expenses, and debt, ask yourself the same questions financial advisors often use. If you can answer the questions, you probably have a good handle ...

March 31, 2023

TDECU Digital Banking gives you the ability to customize alerts we will send to you via text, call, secure message, or email. These alerts will keep you in the know about your account activity – so...

March 30, 2023

The average tax refund in Texas pays $4,317. That’s a considerable amount of money that people can use to improve their lives and financial situations.

March 28, 2023

Users of TDECU Digital Banking must be able to quickly access their accounts and, if required, regain their login credentials. TDECU has introduced a self-service tool that enables customers to unl...

March 23, 2023

Learn the difference between a Credit Union and a larger bank. Explore which may be the best option for you.

March 22, 2023

Considering recent news about a few regional bank failures, it’s completely natural for you to wonder about the security of your deposits and investments.

March 21, 2023

Does the number of credit card cards you carry matter? Carrying multiple credit cards can be beneficial, but too many can lead to financial troubles. Learn how to determine how many credit card acc...

March 9, 2023

There’s several reasons why you may need to start planning for long-term care and how it could affect your retirement. Find out more here.

March 7, 2023

Did you notice an unauthorized inquiry on your credit report? Follow these 6 steps to help protect yourself from becoming a victim of identity theft and protect your finances.

March 2, 2023

You just received a chip credit card. Now, every time you go to a store, there is confusion over whether you insert or swipe your card. Why did credit card companies make a change to a system that ...

February 23, 2023

This blog has been updated to reflect 2023 contribution numbers. Employer 401k, Traditional IRA, and Roth IRA. No matter which investment vehicle you choose to use, make sure you're getting the be...

February 21, 2023

Has a friend or family member asked you to cosign a loan for them? What does that mean, and is it a good or bad idea? We give you the information you need to understand whether cosigning is right f...